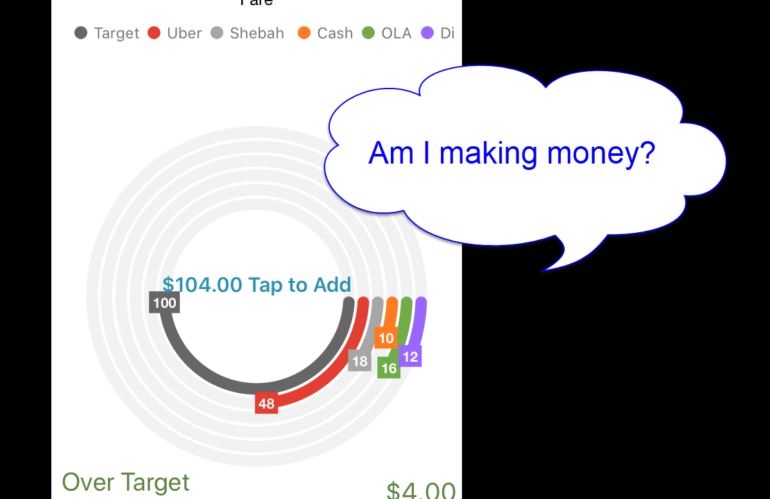

Am I making any money driving rideshare? How much? Is it worth it?

If you’re asking those questions, then you’re looking for the answers. Unfortunately, there isn’t one simple answer.

Even thinking about the question is complicated. You’ll hear, and you may be saying, many things about this subject that are not really backed up by the facts about your driving.

Let me show you how I track my rideshare driving using NextWave Mobile Apps’ product, iDrive For Uber. I’ll show you how it lets me see if I am making decent money… or not.

In this post, I’m using real data from my personal driving record from last week. This week, in particular, illustrates many different realities of driving, reporting, and how I analyze my driving data.

The iDrive for Uber app shows me:

- Did I have a good week driving or not?

- Is this week much different from other previous weeks, or even my whole year?

It’s important to look at things in different scales and over time because our minds play tricks on us. We easily forget, embellish, or just plain misremember what has happened. Few of us can really remember our driving details from last week, let alone 6 months ago.

I’ve learned if I want to understand the facts about my rideshare business so I can improve it, I need to track them, in a computer or this app.

How much have I earned?

I can start with how much money Uber, my rideshare partner, dropped into my bank account. For some drivers, this is the only level of detail they care about and that’s OK.

But I want to know more, so I add fare payouts into the iDrive for Uber app. It’s not hard to do, either in between rides or at the end of the shift. (The iDrive Rideshare app gives you similar information, summarizing earnings from multiple partners instead of by fare type.) Watch the videos on NextWave Mobile apps’ YouTube channel to see the steps involved.

If you add your fare information, the app’s opening page shows you how much you’ve earned in the current year, by fare type.

Are there other ways to find this information without entering fares into the app? Sure! Go to your account on your partner’s website. There’s lots of information about what you have earned so far by trip, day, week, and month. It is all very accurate, but it’s not that easy to understand from the driver’s business point of view.

Especially if you’re trying to answer: Am I making any money?

That is a different question. That answer involves more than seeing the amount deposited into my bank account, which Uber gladly tells me (and the government).

At a glance

Scroll down on the app’s main screen.

Below the graph, I can see what I made this past week and the whole year. Because I’ve entered my fuel purchases as well as my fares, the app gives me some high-level information about both income and fuel expense.

I find this information interesting and 99% of the time, it’s what I really want to watch.

Weekly Summary

So I made about $514 this week at nearly $39/hour working with Uber as my rideshare partner.

Great! I didn’t have to go to Uber and look it up, it’s right there on my phone, all the time.

But $514 is quite a bit more than what I thought I did and $39/hr is way more than ‘typical’ hourly earnings quoted by ‘experts’ online.

I’ve been tracking my data in this app for over three years and this I know: don’t believe anything you see online about this topic unless it is backed up by data, data that’s real.

And honestly, there’s only one set of data that matters to you: YOUR data. Your numbers, your earnings.

Yearly Summary

I also see that I made $4,488.66 at an AVERAGE of $27.25/hr for the year. So, this last week was better than average, but that average is still pretty good for a part-time job I work only when I want to!

Fuel Purchases

I see that I’ve spent $798.77 on fuel expenses. I have other business expenses, I just haven’t added them yet.

Recording my fuel expense keeps track of my actual spending. Fuel is a big business expense and includes GST I’ve paid and claim back. Note this is total fuel expense using my car for any purpose, business and personal. It’s not how much fuel I used to drive Uber. Big difference, as you will see later.

Tax Deduction

So far this year, if I were to use the standard tax deduction approach when filing my income tax, I can deduct $2,154.42 in standard mileage deductions. It will be more than that, I see I need to change the $.57/km to the AU $.66/km rate in Settings—easy.

To use this tax approach in Australia, my total mileage has to be under 5,000 km. I’ll likely be driving more than that and will end up itemizing expenses instead, but I like knowing this number.

Because I use the app every time I drive rideshare, all my business miles are recorded: Total Shift Mileage. That’s the number I’ll use when calculating my taxes. Uber can’t give me that number, ever. They only track mileage driven during fares, about half the mileage related to most trips.

GST

It also shows that I have collected about $503.59 in GST tax for the government. This is an Australian specific tax called a VAT (value added tax) which I have to pay quarterly—money that must be available in my bank account so I can ‘write the check.’ A subject for another day.

So… am I making any money?

Like I said, that answer is complicated, but at first glance, it seems like I am.

Let’s look deeper. To do that, let’s see what data is being used to come up with these numbers.

Looking at trip data

In most cases, I’m most interested in looking at last week’s effort. This week for me was action-packed. It shows examples of extremes and norms, in other words, typical rideshare driver reality.

Here’s what I did last week.

I worked 4 days for a total of 13 hours. I brought home $514 for my efforts and drove 381 kilometers. My hourly rate ranged from $12.04/hr to $55.27/hr!

That’s a huge range! Time to look closer as to why the big differences.

Monday: I was out for a little over an hour and got 1 ride (thankfully, they tipped!) But, I never should have left the house in the first place. No one was about in my usual driving areas. I knew it soon enough and so I just went home. Pick your battles wisely. Some days are like that.

Wednesday: I was out a bit longer than Monday and got 3 trips… and then got rammed by a scooter. The Uber app was on but I didn’t have a fare at the time. Only my car was hurt. That ended my shift in a bad way but it is a good example of an unexpected cost of driving showing up.

So how bad were these days? The app lets me view my earnings by day of the week. You can see how my Mondays and Wednesdays look so far this year.

Earnings on these two days were less than my average. Normally, Mondays are not too bad for me (see below), but I don’t drive a lot Monday-Wednesday. This information is based on only a couple of days of driving on these days.

Friday: I did better on Friday, $245.13. Uber had posted a promotion where if I drove 12 trips after 6PM, I would get an extra $60. Challenge accepted! I drove 6.3 hours and put on 178.5 kilometers to do it. There were some slow times and some busy times. I ended up making $39.22/hr for my efforts, including the promotion and $8 worth of tips.

Saturday: I did even better on Saturday—depending on how I look at it. Uber had the same promotion running, so I did it again! I made less total money, but my hourly rate went to $55.27/hr with no tips but including the promotion. All in 4.3 hours of work—I worked 2 hours less.

So, which do you think was the better day?

But the promotions! You say, No fair! You can’t include them in your hourly earnings.

Well, it is fair because Uber offered a deal and I took it. The promotion, especially on Saturday, increased my hourly earnings rate above my average.

This is how these two days compare to this year’s days-of-the-week averages. I threw in Sunday, too, to show that these two days made no significant difference in the year-to-date averages for any day.

So, am I making any money? Looks like it. At least driving on these days of the week, which is consistent with what conventional wisdom says: rideshare earnings are better on the weekend. Of course. More people are out and about.

Your experience, when and where you drive these days, could be very different from mine! But, my best advice is, don’t just drive, drive strategically, and know your business numbers.

My point is, I have made $3050 so far this year mostly working just these 3 days for 97 hours over 4 months. Could I have made more? Sure! I know I could, if I drove more and at different hours. But I met my personal targets and that was good enough for me… and that’s part of the ‘real’ answer to the questions. How much do YOU need to make? My answer isn’t your answer.

What did I have to do to earn that money?

In a nutshell, we drive people from Point A to Point B. These are the maps the app tracked of where I drove on Friday and Saturday. All over the place, but to very different parts of the city.

Let’s use the Friday example: a total of 178.5 kilometers of driving. That’s the mileage from when I started driving from my house to when I stopped back at my house at the end of the day.

Mileage-related tax deductions are important.

Uber does not track all the miles/kilometers you drive while driving rideshare, but the iDrive for Uber app does. The expenses related to every single one is tax deductible.

How much did it cost to earn that money?

Taxes are complicated. Every driver’s tax situation is different. But yes, taking every tax deduction makes a difference. The app does not do your taxes but it gives you the numbers you need to pay the least amount of tax you have to. A simple example follows.

In Friday’s case, I can deduct $.66/km as the Australia standard deduction: $117.81. That means I’ll only be paying taxes on $127.32 of Friday’s earnings, not the whole $245.13 which went into my bank account.

Again, know your country’s rules. Australians can only claim the standard deduction if they drive less than 5000 kilometers. Drive more than that and expenses must be recorded (which the app does) and proportionally itemized to claim the deduction. GST tax is paid separately, on top of that.

What car you drive matters.

The standard mileage rate used above is meant to be exactly that. Basically, the government reimburses us for all business expenses when we use our car for business. They consider everything from fuel, maintenance, tires, repairs, insurance, and more. All those types of expense are tax deductible and they try to make it as accurate as they can. But, one size does not fit all. We don’t all drive the same make and model car, or drive the same way.

I drive a Mazda 3 hatchback. It gets great gas mileage and is built like a tank. Very reliable. My actual costs are usually less than the $.66/km rate. If I was driving a huge SUV that guzzles gas and that falls apart after about 100,000 miles, the $.66/km rate probably wouldn’t cover my real costs. Something to consider when answering these questions for yourself.

Driving rideshare supports your lifestyle.

Another thing to consider is that the personal cost for me to own a car go way down because my Uber business shares the cost of ownership. The expenses are the same, but by driving rideshare, the business percentage of the costs of just owning the car are deductible. If it was just my personal car, none of them are. Driving rideshare supports my lifestyle, because where I live, I have to have a car to get around.

But am I making any money?

Back to the original questions. For the answers, we must view results over a period of time and for each individual driver/car/place combination.

It matters what you drive. Where you drive. When you drive. How smart you drive. And most importantly, how much you drive.

Drive Uber 9-5 like a normal job in the middle of the day and you will be very lucky to make minimum wage. Drive rush hours and at night, close the bars, and you will make much more. Drive when customers NEED you to drive to make the most money. Seems like common sense.

Most drivers know how much money is going in and out of their their bank account. That is cash flow.

The government wants to know how much money you take in and how much of it is taxable, what’s leftover after you pay expenses. That is profit and loss. Profit or loss is about paying taxes.

You want to maximize your deductions as a driver to minimize your profit, because you pay tax on that amount.

Let’s see how the app can help with that.

Cash Flow

Cash is king. This is real money going in and out of your bank account, easy to see. But let’s look at cash flow on a per hour basis, just to get some comparison numbers. If you add fares and expense, find your cash flow on the My Money page of the app.

Earnings: These are fares you entered, money paid into your bank account.

% Business Use: Unless you use your car 100% for business, you can take only a percentage of your expenses as deductions. The app calculates your % Business Use for you and applies it to the expenses you put into the app.

Net Cash Flow: This is how much of your money you kept after deducting the expenses you put into the app.

Here are two more ways to look at your income.

Gross Earnings/hr (income before expenses)

Net Cash Flow/hr (income after expenses).

For these numbers to have any meaning, remember you need to:

- Use the app every time you drive rideshare so it tracks total shift mileage and can calculate % Business Use of vehicle

- Add your fares and any other partner payments (it calculates gross earnings)

- Add your expenses (at minimum, fuel expense)

These estimates are YOUR real, income per hour numbers. Compare them with other job opportunities and now you can decide for yourself: is driving rideshare worth it?

Profit and Loss

You pay income tax on profits. Just like the big wigs on Wall Street.

Your goal is to offset your earnings with every tax deduction you’re entitled to take. Work it right, and depending on your personal situation, you can end up paying little or no tax.

Looking at Profit

Understanding profit and loss is much harder than cash flow.

Gross Income: This is an estimate of how much the government’s been told you made by Uber. This is what the customer pays to Uber, including all Uber fees—not the earnings deposited into your bank account. The app simply estimates these fees based on what % you defined as your fee percentage value in Settings—use Uber’s statements when actually doing your taxes.

The gross income number is important because, from the government’s perspective, the customer paid YOU, not Uber, this amount. You certainly don’t get to keep it all but this truly is your business ‘Income’.

Taxable Income: This is how much the government agrees you’ve earned, after subtracting your tax deductible business expenses from your gross income. You want this number to be as close to zero as you can get it (take every legal deduction you can to get it there!) because this is the number you pay tax on: your profit.

Tax Estimate: You set the estimated % tax rate to be what makes sense in your personal tax situation, based on your personal tax history.

Estimated After Tax Profit (loss): The app does the math. This is how much you earned after paying the estimated taxes on your earnings (profit).

Looking at profit per hour.

Gross Income Per Hour. This is what you actually are paid, believe it or not, although it’s not what shows up in the bank. This what the customer pays to you, via Uber, before any business expense deductions, including all Uber fees!

Taxable Income Per Hour. This estimates what you earn after estimating and subtracting your deductions for Uber fees and the mileage business expense in the app. When you actually do your taxes, any 100% business use expense brings the number down more. This is good!

The number seems low right? I only make $12.94/hr!!!

Well, a McDonald’s worker doesn’t take home his entire paycheck either. State and federal taxes are taken out BEFORE the money goes into his bank account. Employees pay some taxes BEFORE taking any deductions, on a bigger number, and they can’t even take the same deductions you can. So even if they are hired at $25/hr, $25/hr is not what shows up in their bank account as earnings.

Again, some of your business deductions also support your general lifestyle. Do your research or talk to an accountant about the details, but the fact you pay tax on money AFTER deductions because you are a business, not an employee, is a big financial advantage to you. Helps make up for the challenge of running your own business!

After Taxes Per Hour. This is what many say drivers make! It is not a real number, but if you can make this number the same or close to Taxable Income Per Hour, then you paid very little tax.

So, when comparing this hourly number to any other hourly number, be sure you are comparing after tax numbers to after tax numbers. You want this number to be as small as possible.

Rich people know this. They often don’t pay any taxes. Why? Because they literally make $0 after their deductions. Yet somehow, they’re rich.

That’s it. Of course, if you don’t track all shift mileage and enter income and expenses, these app screens will be of no use to you.

Can’t I do all this from Uber?

Well, no, you can’t. You can do a lot of it, but not all of it, and not without a lot of work. Let’s look at what this same week looks like using Uber reports.

Daily Earnings

This report shows you what you have done for any week. Just like the app does. But you need to notice a few things!

- The daily totals do not give you the same information as you can see from the app, the earnings plus the visual break-out of your fare types. Tips are there but you can’t see them with their trip. Promotion fees paid have to be found and added in separately (add $60 to $174.91 = $234.91 for Saturday’s actual pay-out).

- You can see the mileage you were paid to drive on each trip. But what was your total mileage for each trip, driving to and from drop-off? There’s no total shift mileage, the number you need as your tax record, whether you use a standard deductible rate, a vehicle log (another tax record approach), or an actual mileage record to do your taxes.

Saturday Earnings: $234.91 (promotion not included)

Weekly Earnings

This report is also available by the week, but it serves Uber’s needs more than yours.

In this view, the total income for Saturday displays: $234.91. But you can’t confirm that the promotion was included without doing some math. Promotions are only shown in the weekly totals.

Note: Uber’s CSV files can be downloaded from Uber and imported into the app, but doing that is of limited value.

How much money AM I making?

Way more than minimum wage but any ‘per hour’ number is not the right answer. Even thinking in those terms gets in the way of how you think about your business.

Here’s my answer, how I look at it. If I’m making enough cash for whatever, enjoy flexible hours, and pay low taxes, then maybe the answer is, “Enough.”

If the answer is, “Not enough,” then I need to look elsewhere for a different income source.

For more information about the NextWave Mobile Apps product(s) described in this post, follow these links:

Apps

I write apps. My company is NextWave Mobile Apps and you are probably reading this blog on our website.

I started driving rideshare to learn the rideshare business so I could understand the drivers’ world and develop an app to make drivers’ life easier. Back when it was ‘illegal’ to drive rideshare.

If you want to run your rideshare business like a business, try one of our apps! They are FREE to use.

- iDrive For Uber. Specific to tracking mileage, expenses, fares, fuel purchases, etc. for drivers who use Uber (or any other platform).

- iDrive Rideshare. The same app as iDrive For Uber but it tracks earnings by platform instead of by type–see your totals from all platform providers in one place.

- iDrive Mileage. For those who only want to track their mileage and don’t care about income, expenses, fuel, etc. Works for employees, too, not just rideshare drivers.

- iDrive Car Cost Calculator. An app that lets you play ‘What if…’ with income and expense issues, like those discussed in this article.